ARROWHEAD PHARMACEUTICALS (ARWR)·Q1 2026 Earnings Summary

Arrowhead Beats Big as REDEMPLO Launch and Major Deals Drive First Profitable Quarter

February 5, 2026 · by Fintool AI Agent

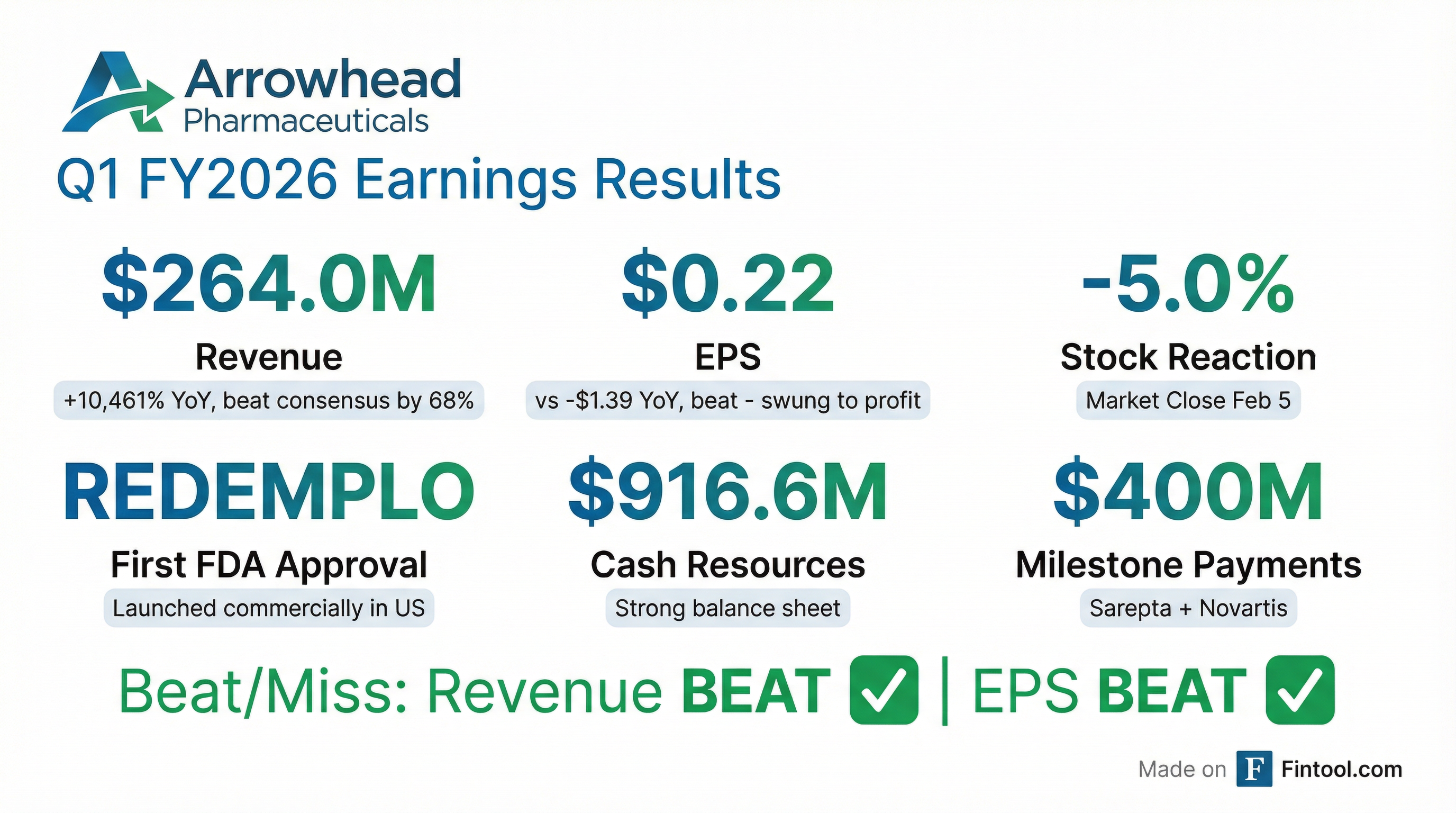

Arrowhead Pharmaceuticals reported transformational Q1 FY2026 results, crushing revenue estimates and swinging to its first profitable quarter as the company transitions into commercial-stage biotech. Revenue of $264.0M massively beat the $157.3M consensus (+68%), driven by milestone payments from Novartis and Sarepta, while diluted EPS of $0.22 compared favorably to the expected loss of -$0.16 .

The quarter was defined by major achievements: FDA approval of REDEMPLO (plozasiran) for Familial Chylomicronemia Syndrome (FCS), a successful independent US commercial launch with 100+ prescriptions already received, and additional regulatory approvals in China and Canada .

Did Arrowhead Beat Earnings?

Yes, significantly. Arrowhead delivered beats on both revenue and EPS:

*Values retrieved from S&P Global.

Revenue breakdown ($264M total):

- Sarepta collaboration: $229M

- $181M from achieving second ARO-DM1 milestone

- $32M from ongoing recognition of initial Sarepta consideration

- $17M from reimbursement of collaboration program costs

- Novartis upfront: $34M recognized from $200M upfront payment

- REDEMPLO commercial revenue (first product sales, amount not disclosed)

Note: Q1 cash of $917M does not include the $200M ARO-DM1 milestone received in January, nor the $50M anniversary payment expected from Sarepta by February 10

What Did Management Say?

CEO Chris Anzalone struck a confident tone, highlighting the historic nature of the quarter:

"We had another quarter of strong execution across all areas of our business, and we are well-positioned to build on this progress throughout 2026 and beyond. In fact, the recent months have included some of the more significant achievements in Arrowhead's history."

"This is indeed an exciting time to be an Arrowhead or an Arrowhead shareholder. We're coming off an historic period for the company, where we executed extremely well, and all the hard work of the last several years is starting to pay off."

Key achievements highlighted:

- First FDA approval — REDEMPLO approved November 18, 2025

- Successful commercial launch — 100+ prescriptions, diverse prescriber base, geographically balanced uptake

- Global regulatory progress — Additional approvals in Canada and China

- Growing cardiometabolic portfolio — ARO-DIMER-PA (first dual-gene RNAi) entered Phase 1/2a

- Promising obesity data — ARO-INHBE + tirzepatide showed ~2x weight loss, ~3x fat reduction vs tirzepatide alone

- CNS pipeline advancement — ARO-MAPT entered clinic utilizing new BBB-penetrating delivery system

- Balance sheet strengthened — $1.33B in gross proceeds from recent transactions

How Did the Stock React?

Despite the significant beat, ARWR shares closed down 5.0% at $64.64 on February 5, 2026. The stock is down 4.6% year-to-date but has gained over 500% from its 52-week low of $9.57.

Why the muted reaction? The revenue beat was largely driven by one-time milestone payments ($400M from Novartis and Sarepta) rather than recurring commercial revenue. Investors may be waiting to see REDEMPLO commercial traction materialize into sustainable revenue before re-rating the stock.

The stock has been on a tear since Q4 FY25 when Arrowhead beat estimates with the Novartis/Sarepta deals, rising from ~$27 to the current ~$65 level.

What Changed From Last Quarter?

Major developments since Q4 FY25:

Key Pipeline Updates

Cardiometabolic:

- Plozasiran SHTG (Phase 3): Breakthrough Therapy designation; SHASTA-3, SHASTA-4, and NEAR-3 enrolled ~2,150 patients; top-line data expected Q3 2026, sNDA submission planned before year-end . Management describes SHTG as a "$3-4 billion commercial opportunity"

- 37% of enrolled patients have TGs >880 mg/dL (high AP risk threshold)

- 20% have prior history of pancreatitis

- ARO-DIMER-PA: First-in-class dual PCSK9/APOC3 inhibitor in Phase 1/2a — first RNAi to target two genes simultaneously. Looking for ~40-50% reductions in both LDL and TGs based on monkey data; interim data expected H2 2026

Obesity (GLP-1 combination potential):

- ARO-INHBE + tirzepatide: ~2x weight loss at week 16 vs tirzepatide alone in obese diabetics

- Fat reduction: ~3x improvement in visceral fat, total fat, and liver fat vs tirzepatide alone

- ARO-ALK7: First RNAi to show adipocyte gene silencing in humans, -88% mean reduction in adipose ALK7 mRNA at 200mg dose (max -94%)

- Development path: FDA discussions planned for mid-2026, IND filing shortly thereafter

CNS (TRiM Platform):

- ARO-MAPT: Phase 1/2a for tauopathies/Alzheimer's — interim healthy volunteer data expected 2026 (focus on safety and CSF tau knockdown), Alzheimer's patient data in 2027 including tau PET signals

- ARO-SNCA: Licensed to Novartis for $200M upfront + up to $2B in milestones + low double-digit royalties

REDEMPLO Commercial Launch Details

REDEMPLO (plozasiran) is the first and only siRNA FDA-approved treatment for both genetically confirmed and clinically diagnosed FCS patients .

Early launch metrics (first 10 weeks):

- 100+ prescriptions received from diverse prescriber base

- Prescriber mix: 70% from preventive cardiologists and endocrinologists, remainder from internal medicine physicians focused on lipid disorders

- Patient sources: "Overwhelming majority" are APOC3-naïve; remainder split 50/50 between Expanded Access transitions and olezarsen switches

- Switch drivers: Efficacy and safety are principal reasons for olezarsen switches

- Turnaround time: Prescription to drug shipment in "just a couple of weeks"

- Majority of patients not required to submit genetic testing for access

- Geographically balanced uptake across the US

Pricing strategy: "One-REDEMPLO" pricing model creates consistent price across current and potential future indications. For SHTG, initial focus is on the high-risk population of 750K-1M patients with TGs >880 or prior pancreatitis history .

Patient support: High proportion enrolled in "Rely On REDEMPLO" program; patients eligible for co-pay assistance paid $0 out of pocket in Q1 .

Balance Sheet and Cash Position

January 2026 Capital Raise ($1.33B in gross proceeds):

- $700M convertible senior notes: 0% coupon, 35% conversion premium

- $230M common stock offering

- Capped calls prevent dilution up to $119/share (~85% premium)

- Cost of capital estimated below 1.5% at any share price under $119

CFO Dan Appel: "We have very significantly and efficiently strengthened our balance sheet, which provides additional flexibility to support ongoing clinical development, current and future commercialization activities, and other long-term strategic priorities."

R&D and Operating Expenses

Total operating expenses increased $59M YoY to $223M :

Management noted commercial capabilities were "intentionally designed to be highly leverageable downstream" for potential plozasiran SHTG and zodasiran HoFH approvals .

Q&A Highlights

On commercial launch traction:

"We're seeing really high-quality prescriptions in the sense that we believe these prescriptions truly represent either genetically confirmed or clinically diagnosed FCS patients... we're able to [convert] within just a couple of weeks from prescription to patient receiving drug." — Andy Davis

On SHTG pricing and market size:

"When we look at our initial target market there... it is really focused on those very high-risk individuals, those maybe 750,000 to maybe 1 million people who have triglycerides above 880 or a history of pancreatitis... don't get lost in the 3-4 million people with trigs above 500." — Chris Anzalone

On obesity development:

"FDA conversations probably middle of the year, and then we'd be looking to file an IND shortly thereafter." — James Hamilton on moving ARO-INHBE to Phase 2

On ARO-MAPT (Alzheimer's) readouts:

"The key data that we anticipate being confidence building, of course, safety, and then the CSF knockdown will be key in the healthy volunteers... going forward into the patient cohorts, we can measure some of the phospho-tau varieties in the blood, also in the CSF, and then tau PET." — James Hamilton

Forward Catalysts

2026 Key Events:

Partnerships:

- Sanofi marketing REDEMPLO in Greater China

- Novartis advancing ARO-SNCA (up to $2B in milestones)

- Sarepta developing SRP-1005 for Huntington's (CTA submitted)

Key Risks

- Revenue sustainability — Q1 revenue was heavily driven by one-time milestone payments; commercial revenue remains nascent

- REDEMPLO competition — Ionis/AstraZeneca's olezarsen is in the same APOC3 class

- Clinical execution — Multiple Phase 1/2 programs require successful advancement

- Cash burn — R&D and commercial buildout costs are increasing rapidly

The Bottom Line

Arrowhead delivered a landmark quarter that validates its transition to commercial-stage biotech. The FDA approval and launch of REDEMPLO, combined with $400M in milestone payments and promising pipeline data (especially in obesity), positions the company well for 2026.

What to watch:

- REDEMPLO Rx trajectory — Early traction is encouraging but sample size remains small

- Q3 2026 SHTG readout — SHASTA-3/4 data will determine the "$3-4B opportunity"

- H2 2026 ARO-DimerPA data — First proof-of-concept for dual-gene RNAi

- Mid-2026 FDA obesity discussions — Could accelerate ARO-INHBE development

The stock's muted reaction (-5% on the day despite massive beats) suggests investors want to see sustainable commercial revenue before further re-rating. With $917M cash (plus $250M incoming), the company is well-funded through multiple potential launches.

Data sources: Arrowhead Pharmaceuticals Q1 FY2026 earnings call transcript, February 5, 2026; S&P Global consensus estimates.